Reviewing the Roller Coaster Rates of 2024

The mortgage industry is no stranger to twists and turns, and 2023 was a testament to its unpredictable nature. Variable rate holders faced a challenging year with three prime rate increases, totaling a 0.75% hike. As the year unfolded, fixed rates took mortgage holders on a roller coaster ride, making 2023 a memorable year for the real estate market. Now, as we stand at the cusp of 2024, it's time to reflect on the past and prepare for what lies ahead.

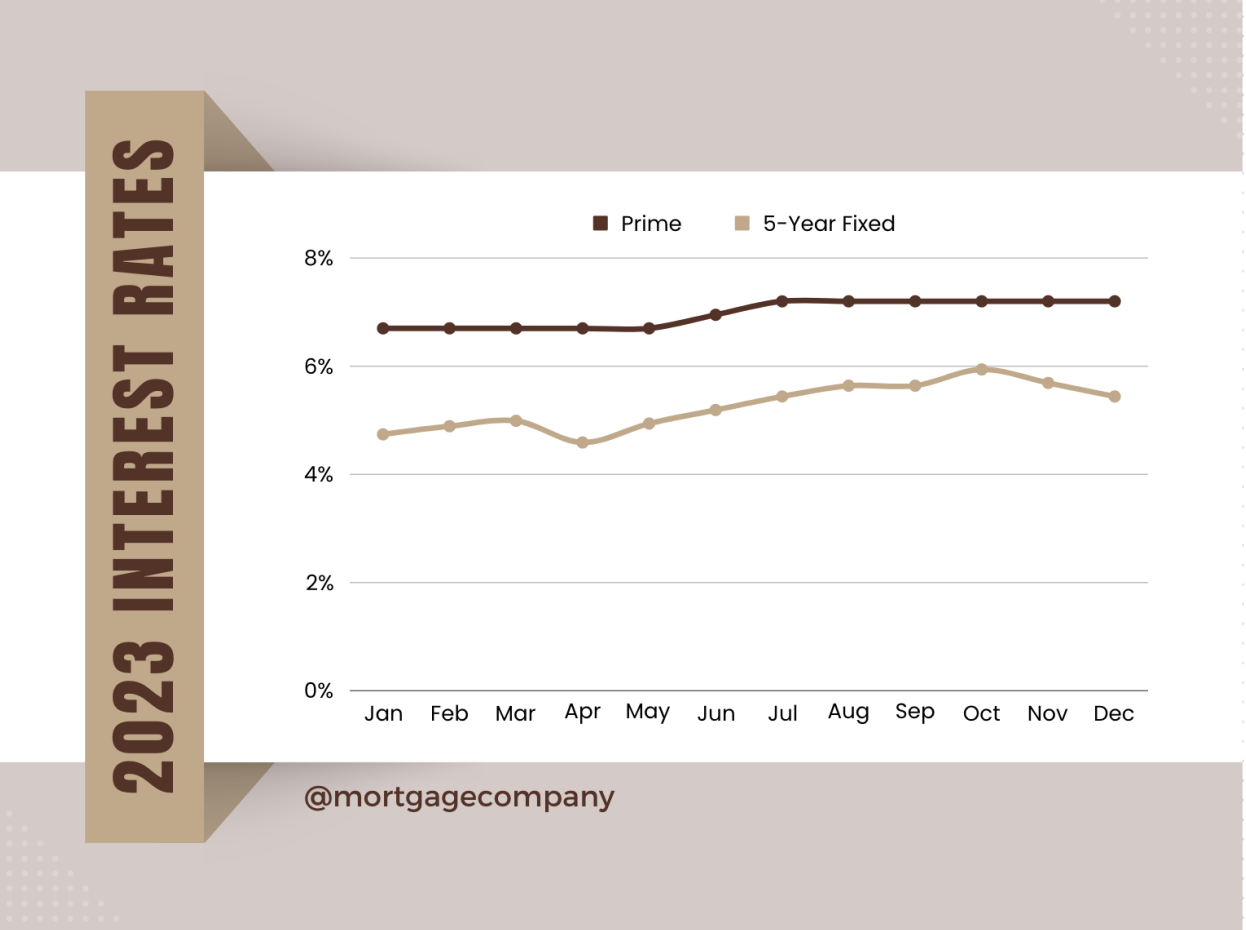

The Roller Coaster of Fixed Rates in 2023:

In the tumultuous landscape of 2023, the trajectory of fixed mortgage rates resembled a heart-pounding roller coaster ride, where each month brought unexpected twists and turns, leaving homeowners and industry experts gripping the safety bars of uncertainty. The journey began in January at a seemingly stable 4.74%, only to take an incline to 4.89% in February. March brought a steep climb to 4.99%, creating a sense of anticipation that plummeted unexpectedly to a low of 4.59% in April.

But hold on tight, for the roller coaster continued its wild journey – 4.94% in May, a daring leap breaking the 5% barrier at 5.19% in June, a climb to 5.44% in July, and a steady ascent maintaining 5.64% in August and September. Just when it seemed the ride might level off, October saw an unprecedented surge to 5.94%, followed by a downward trend to 5.69% in November. As the year came to a close, the rates now hover around 5.44% for most lenders in December, leaving everyone on this wild ride wondering what twists awaited them in the upcoming year

Please note the above interest rates are represent examples of the 5-year fixed insured mortgage rates throughout 2023.

Predictions for 2024:

As we anticipate the coming year, economists are speculating on the trajectory of mortgage rates in 2024. Some foresee as many as three prime rate decreases, totaling around 0.75%, offering relief to variable rate holders. This adjustment could bring the prime rate back to approximately 6.45%, still higher than the preceding years but more reasonable for those with adjustable rate mortgages. Further decreases are expected in 2025, especially if inflation continues its downward trend. Lenders and banks are faced with the challenge of addressing the millions of homeowners due for mortgage renewals, having secured historically low rates during the pandemic.

Fixed rates, as predicted by wowa.ca, may experience a more stable trajectory in 2024. The roller coaster of the 5-year insured rate is expected to gradually decrease to around 4.59%. However, most predictions converge on one central theme – the era of historically low rates, seen during the pandemic, will likely never happen again. Borrowing money is likely to settle around the 5% range for some time, emphasizing the need for homeowners and prospective buyers to adjust to a new normal in the mortgage landscape.

Conclusion:

As we bid farewell to the unpredictable twists of 2023, the mortgage industry is poised for a year of potential adjustments in 2024. Whether you are a current homeowner, a prospective buyer, or a real estate enthusiast, understanding the market trends and staying informed is crucial. While economists may provide insights, the unpredictable nature of mortgage rates reminds us that preparation and flexibility are key. So, as you contemplate homeownership in 2024, there's no time like the present to get started. Consider a pre-approval to set your goals and aspirations for the year ahead, navigating the real estate landscape with confidence. Call today to embark on your journey into the dynamic world of homeownership.

All Rights Reserved | The Mortgage Centre - Elite | Privacy Policy

Website produced by Evolv Digital Marketing Inc.