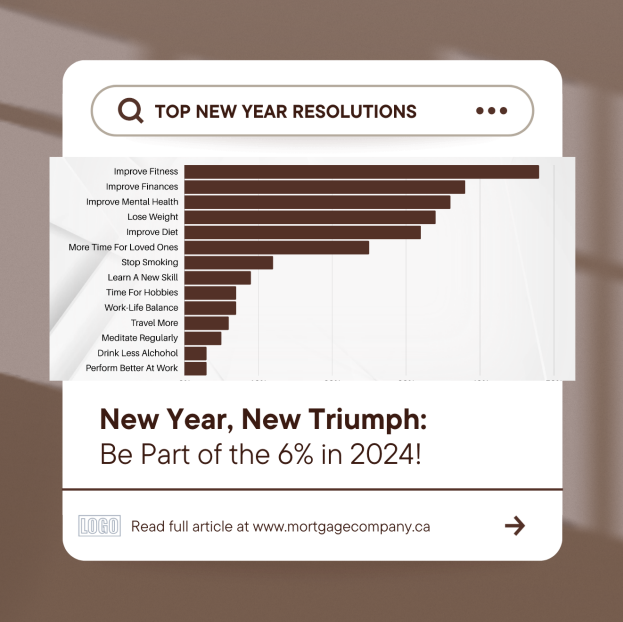

New Year, New Triumph: Be Part of the 6% in 2024!

Happy New Year to each valued client and supporter! I want to express my heartfelt gratitude for being an integral part of my mortgage broker journey. Your support has been the cornerstone of my business, and I appreciate each step we've taken together. As we embrace 2024, let's not only celebrate but also delve into the essence of the new year.

Canva Template HERE

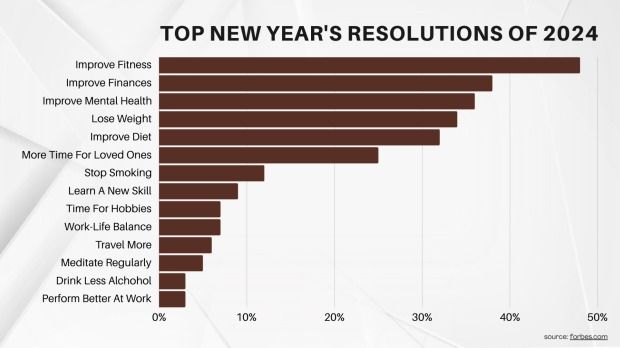

Beyond the festivities, the new year often symbolizes an opportunity for reinvention—a chance to dream big and set ambitious goals. Many of us engage in the tradition of making New Year's resolutions, envisioning a brighter future. However, let's acknowledge the reality: while 80% felt confident in achieving their goals, only 6% stuck with resolutions from the prior year. What distinguishes those who turn aspirations into accomplishments?

1. Set Realistic and Specific Goals:

Move beyond broad resolutions by defining clear and attainable objectives. If homeownership is in your sights, establish a specific savings target for a down payment. This precision brings focus to your goals and facilitates effective tracking.

2. Create a Detailed Plan:

Break down your resolution into manageable steps. For instance, if consolidating debts into your mortgage is the goal, develop a step-by-step plan to execute this process. Detailed planning transforms larger goals into actionable tasks.

3. Regularly Review and Adjust

Commit to periodic reviews of your progress. Life is dynamic, and circumstances may change. Regular assessments empower you to adapt your strategies, ensuring they stay relevant and effective.

4. Leverage Professional Guidance:

Engage with experts, such as myself, your dedicated mortgage broker, to navigate financial complexities. Take advantage of complimentary consultations to gain insights into mortgage planning, debt consolidation, and investment strategies. Professional guidance offers clarity and direction.

5. Cultivate Accountability:

Share your resolutions with a trusted friend or seek professional accountability. As your mortgage broker, I can play a pivotal role in keeping you on track. Regular check-ins and quarterly reviews provide external support and guidance as you pursue your financial goals

How can I help?

As we focus on your resolutions, here are tailored services I provide to support your journey:

Free Consultations: Explore your financial goals, whether it's homeownership, debt consolidation, or investment planning. Complimentary consultations provide a platform to discuss personalized strategies.

Accountability: I am committed to keeping you on track. Regular check-ins ensure you remain focused on your resolutions, with adjustments made as needed to foster a proactive approach.

Quarterly Reviews: Periodic assessments allow us to gauge your progress, address challenges, and refine your financial plan. Ongoing collaboration ensures your resolutions align with the evolving landscape of your life.

Education: Empowering you with knowledge is fundamental. Gain insights into mortgage options, financial literacy, and investment opportunities. Education equips you to make informed decisions about your financial future.

Tailored Strategies: Your financial journey is unique. My expertise lies in crafting personalized strategies that align with your goals, whether it's optimizing your mortgage or formulating an investment plan.

Conclusion:

By incorporating these habits and leveraging the support of your dedicated mortgage broker, you position yourself among the successful 8% who transform resolutions into lasting achievements. Let's embark on this journey together, turning your financial aspirations into reality. Contact me for your personalized New Year planning consultation, and let's make 2024 a year of financial empowerment and success.

Source:

Forbes

Canva Template: CLICK HERE

BONUS EMAIL TEMPLATE:

*Don’t forget to add your own personal links

Subject: Join the 6% Succeeding in New Year Resolutions!🚀

Dear [Recipient's Name],

Happy New Year! 🎉 I trust this message finds you well and enjoying the beginning of 2024. I wanted to personally share with you some insights and strategies for making this year truly transformative. In my latest blog post, I delve into the art of successful New Year's resolutions and how, with the right approach, you can be among the 6% who turn dreams into reality. Curious to discover the key habits and personalized strategies? Click [here] to read the blog.

Wishing you a fantastic start to the year, and here's to achieving your financial goals in 2024!

Best regards,

[Your Full Name]

[Your Position]

[Your Company]

[Blog Link]

BONUS #2 VIDEO SCRIPT:

*Best to use in your story so you can add the link to your blog.

Did you know that 80% of people feel confident about their New Year's resolutions, but only 6% actually stick with them? Discover why and learn to be part of the successful few! Click on my latest blog for helpful tips. Are you setting financial resolutions? Let's chat! Call for a free New Year Mortgage Consultation!

All Rights Reserved | The Mortgage Centre - Elite | Privacy Policy

Website produced by Evolv Digital Marketing Inc.