You Missed the Best Time to Buy—Now What?

Let’s be real—2020 was a great time to buy a home. Prices were lower, and mortgage rates were sitting at 2.84%. But if you didn’t buy then, you’re not alone. Many people hesitated, waiting for the “perfect” time to enter the market.

Now, home prices are higher, rates have fluctuated, and some buyers are still waiting. But here’s the truth: there is no perfect time to buy—only the right time for you.

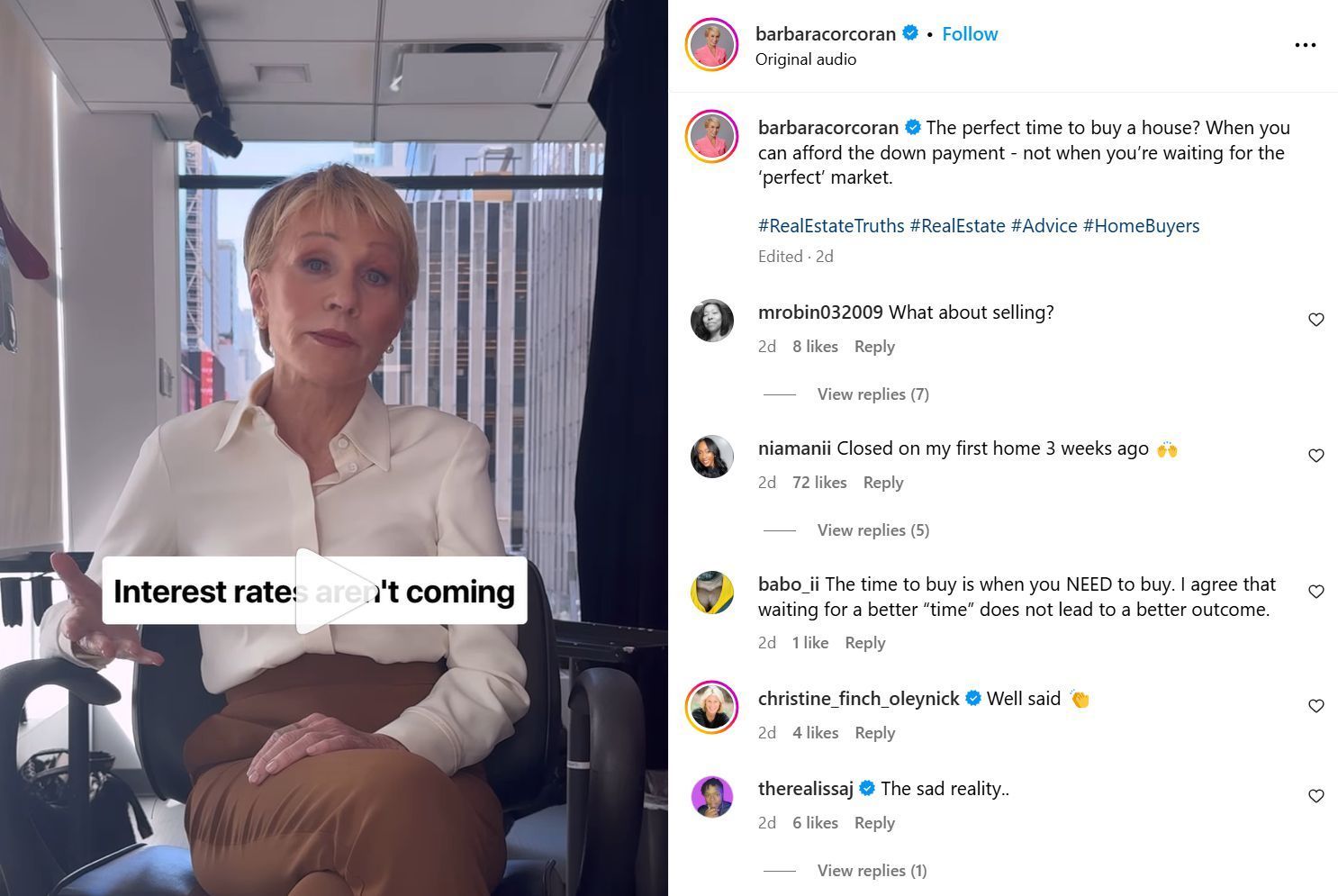

Barbara Corcoran

@barbaracorcoran puts it:

"The perfect time to buy a house? When you can afford the down payment—not when you’re waiting for the ‘perfect’ market."

The Market Has Moved—And It’s Not Waiting for You

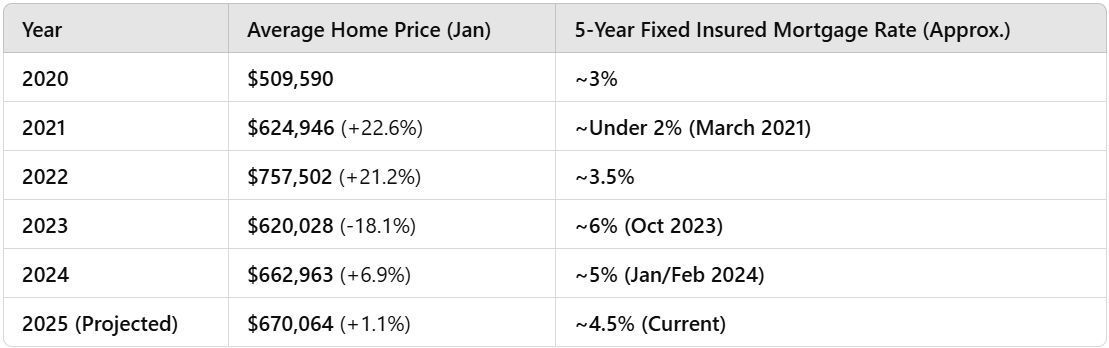

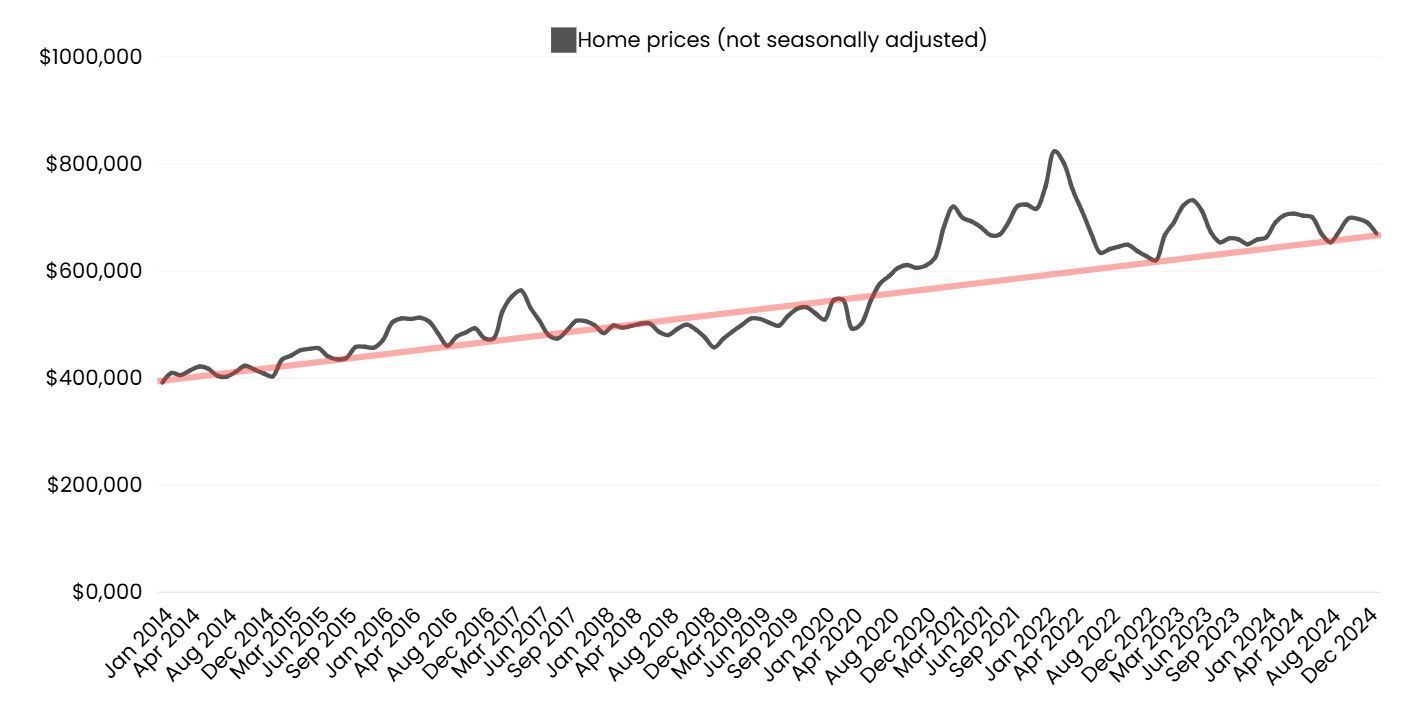

Here’s how Canadian home prices have changed over the years:

Prices skyrocketed from 2020 to 2022, driven by record-low interest rates.

- The market dipped in 2023, but it’s already rebounding.

- CREA forecasts home prices will rise another 3.3% in 2026 to $746,379.

Barbara Corcoran

@barbaracorcoran and other real estate experts agree: waiting often costs buyers more in the long run.

Interest Rates Fluctuate—Home Prices Keep Rising

If you’re holding off because of interest rates, here’s what you should know:

- Rates are already lower than their peak. After hitting 5.94% in late 2023, they’ve dropped to around 4.5% today (depending on the lender and mortgage type).

- When rates drop, prices rise. More buyers enter the market, increasing demand and pushing home values higher.

- Historically, home prices always increase over time. Even after temporary dips, the long-term trend is up.

The key takeaway?

You don’t wait to buy real estate—you buy real estate and wait.

What’s the Right Choice for You?

If you have long-term stability, a lower rate with a higher penalty might be fine. But if you have any uncertainty in your future plans, it may be worth paying a slightly higher rate in exchange for a lower penalty.

Play the Long Game—Not the Waiting Game

Barbara has seen it all, and she knows that getting into the market when you can afford it is more important than waiting for the “perfect” time. Here’s why:

1. Equity Growth – The longer you own, the more your home appreciates and builds your wealth.

2. Market Stability – Short-term dips happen, but history shows that prices always recover.

3. Wealth Creation – Real estate remains one of the best long-term investments for financial security.

If you’re still waiting, ask yourself: Will homes be cheaper five years from now? The data says no.

📞 Call us at 780-370-1490

📧 Email barb@barbpinsent.com

Let’s talk about getting you into the market—before prices rise even more.

All Rights Reserved | The Mortgage Centre - Elite | Privacy Policy

Website produced by Evolv Digital Marketing Inc.