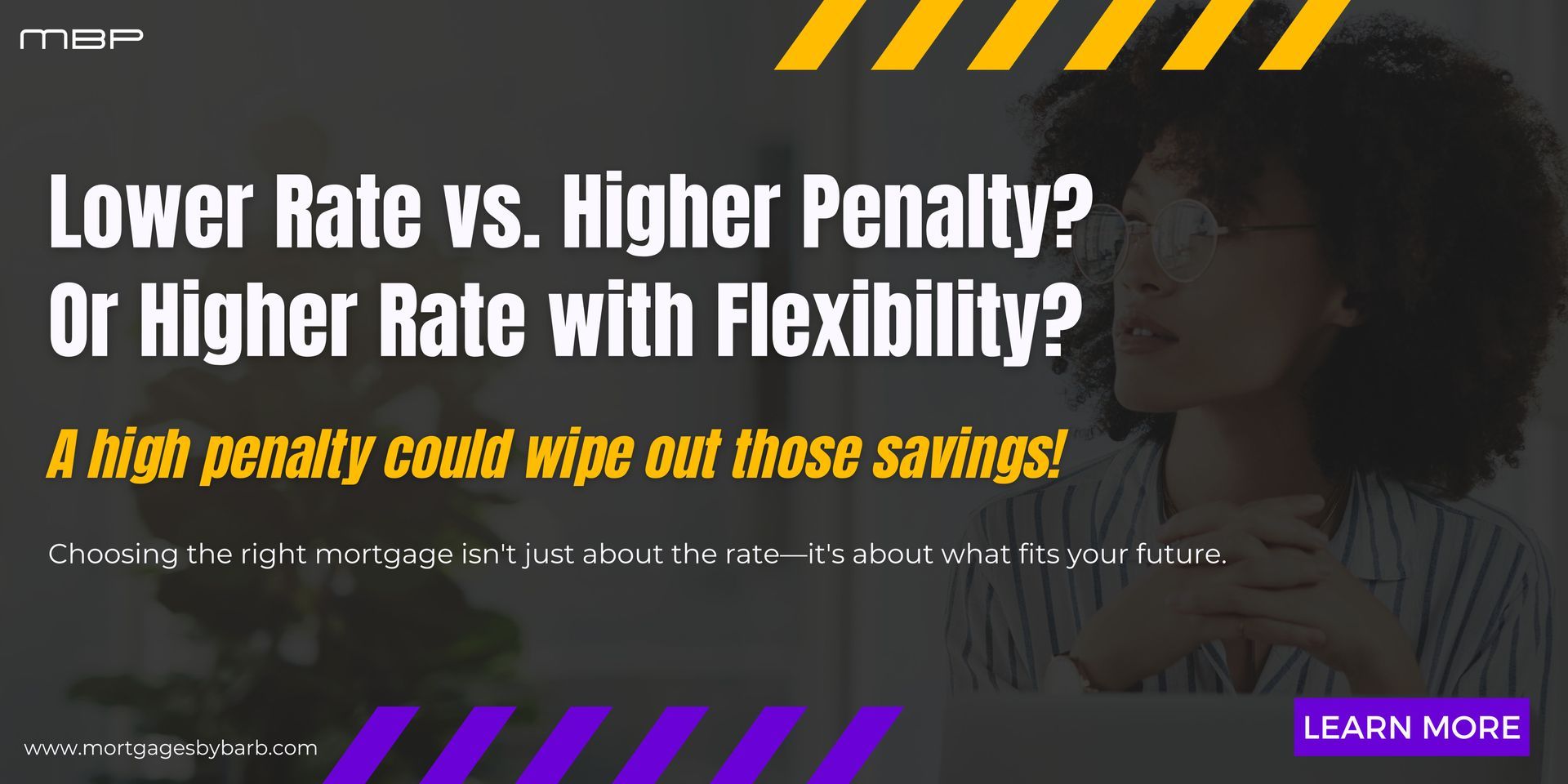

Lower Rate with Higher Penalty OR Higher Rate with Lower Penalty?

When choosing a mortgage, many borrowers focus on getting the lowest interest rate. But what happens if life throws a curveball and you need to break your mortgage early? The penalty for breaking a mortgage can be significant—sometimes wiping out any savings you gained from a lower rate. That’s why it’s important to weigh your options carefully:

- A lower rate with a higher penalty can save you money in interest but can be costly if you break your mortgage early.

- A higher rate with a lower penalty gives you flexibility, making it easier and cheaper to

So, which option is better? It depends on your future plan exit your mortgage if needed.

When Should You Consider a Mortgage with a Lower Penalty?

If your plans are uncertain or you anticipate a major life change, a mortgage with a lower penalty could be the better choice. Here are some common situations where flexibility matters more than the lowest rate:

- Career Changes: If you expect a job transfer, promotion, or career shift that requires moving within a few years.

- Growing Family: If you’re in a starter home but anticipate needing more space soon.

- Potential Separation or Divorce: While not an easy topic, major life changes can make it necessary to refinance or sell your home.

- Investment Properties: If you’re testing the waters with real estate investing but may sell or refinance in the near future.

In these cases, breaking your mortgage early with a high penalty could cost you thousands—sometimes more than you saved with a lower rate.

How Mortgage Penalties Work

Lenders count on borrowers to keep their mortgage for the full term. If you break your mortgage early, they charge a penalty to recover lost interest. The penalty amount depends on your mortgage type:

| Mortgage Type | Typical Penalty for Breaking Early |

|---|---|

| Variable Rate Mortgage | Usually three month' interest |

| Fixed Rate Mortgage | Greater of: Three months' interest OR the Interest Rate Differential (IRD) |

The IRD is where penalties can skyrocket. It’s calculated based on the difference between your original mortgage rate and the lender’s current rate for the remaining term. If rates have dropped significantly, this can result in a massive penalty. Not just a few thousand, I’ve seen penalties as high as $30,000 before.

For example:

- You locked in at 5% for 5 years but break your mortgage in year 3.

- The lender’s rate for a 2-year term is now 3%.

- The lender will charge a penalty based on the difference in lost interest—potentially tens of thousands of dollars.

This is why

choosing the right mortgage term and flexible lender is just as important as getting the lowest rate.

What’s the Right Choice for You?

If you have long-term stability, a lower rate with a higher penalty might be fine. But if you have any uncertainty in your future plans, it may be worth paying a slightly higher rate in exchange for a lower penalty.

Questions to Ask Before Choosing a Mortgage

1. How long do I realistically plan to stay in this home?

2. Could my job require me to relocate within the next few years?

3. Do I anticipate major life changes (marriage, children, separation)?

4. Am I comfortable with the risk of paying a high penalty if I need to break my mortgage?

A mortgage is a long-term commitment, but life isn’t always predictable. By choosing the right mortgage structure, you can avoid costly surprises down the road.

Need Help Finding the Right Mortgage?

Not sure which option makes the most sense for you? Let’s talk. I can help you evaluate your options and choose a mortgage that fits both your short-term and long-term plans.

📞 Call us at 780-370-1490

📧 Email barb@barbpinsent.com

Let's find the right mortgage for you—one that works for your life today and tomorrow.

All Rights Reserved | The Mortgage Centre - Elite | Privacy Policy

Website produced by Evolv Digital Marketing Inc.