Debt Consolidation through Mortgage Refinancing

Introduction:

Are you tired of feeling like you're constantly playing catch-up with your finances? The struggle with debt can often feel like an April Fool's prank that never ends. But fear not, because there's a strategic move you can make to turn the tables on your debt – debt consolidation through mortgage refinancing.

What is Debt Consolidation?

Debt consolidation isn't just a buzzword; it's a game-changer. Essentially, it involves combining multiple debts – such as credit cards, car loans, or student loans – into your mortgage. This streamlines everything into one simple monthly payment at a lower interest rate, offering financial relief and peace of mind.

The Benefits of Debt Consolidation:

1. Lower Interest Rates: By consolidating your debts into your mortgage, you can benefit from lower interest rates compared to other forms of debt, such as credit cards or personal loans. This means more of your payment goes towards reducing your principal balance, helping you pay off your debt faster.

2. Simplified Finances: Juggling multiple payments with varying due dates and interest rates can be overwhelming. Debt consolidation simplifies your finances by consolidating everything into one easy-to-manage payment, reducing stress and confusion.

3. Improved Cash Flow: With a single, lower monthly payment, you'll have more cash flow available each month. This extra money can be used to cover expenses, build savings, or invest in your future.

4. Potential for Home Equity Access: Through a cash-out refinance, you can tap into your home's equity to fund home improvements, cover major expenses, or even treat yourself to a well-deserved vacation. This provides additional financial flexibility and opportunity.

How it Works:

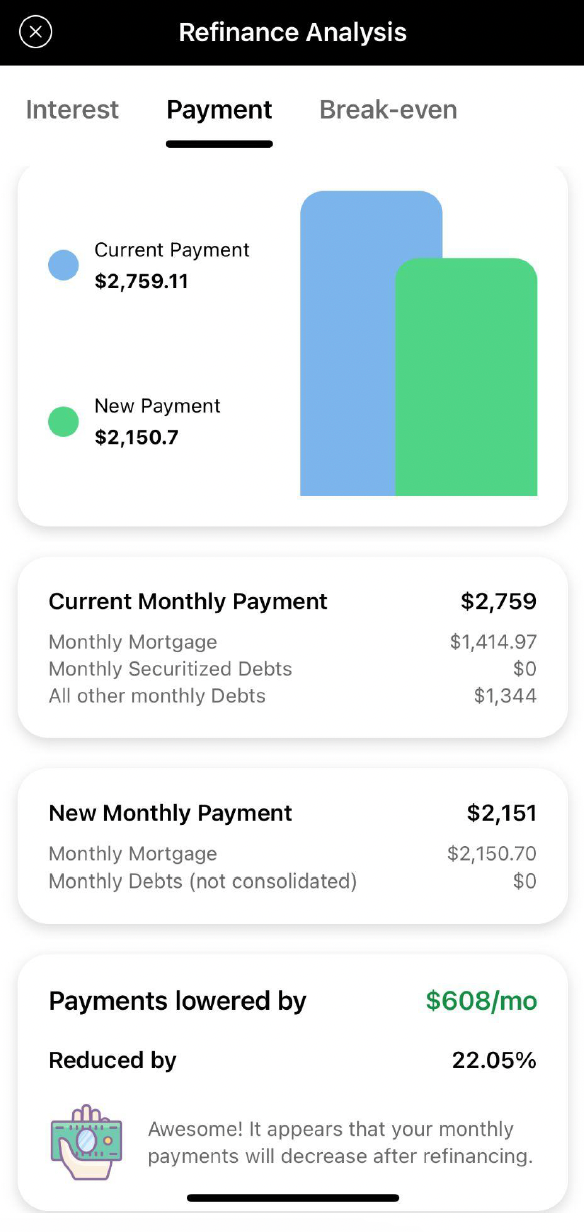

Let's break it down with an example*. If you previously had an interest rate of around 3.19% and needed to refinance, even at a higher rate like 5.59%, you might still save money on your cash flow, depending on the amount of debt you need to consolidate.

- Original mortgage: $275,000 at 3.19%

- Additional debts to consolidate: $4,200 credit card, $10,000 line of credit, $45,000 car loan, $22,000 student loan

- Most payments were interest-only, meaning it would take a long time to pay them off

- Assumed penalty and fees to break existing mortgage: $6,500

- By consolidating these debts into the mortgage and adding an extra $15,000 for a financial cushion, the overall payments decreased by $608 per month, which is a reduction of 22.05%!

By consolidating your debts into your mortgage, you're gaining financial freedom and peace of mind. Contact me for accurate reports and break-even points tailored to your situation will show you when you'll start saving money compared to your current setup.

*The example provided is for illustrative purposes only. This is not a commitment to lend, pre-approval or approval. Rates are assumed and subject to change without notice.

Taking Control of Your Finances:

It's time to take control of your finances and pave the way for a brighter future. With debt consolidation through mortgage refinancing, you can stop dodging calls from bill collectors and lose sleep over mounting debts. Instead, you'll have the opportunity to hit the financial reset button and focus on achieving your financial goals.

Conclusion:

Debt consolidation through mortgage refinancing is more than just rearranging numbers – it's about transforming your financial future. If you're ready to stop fooling around with your finances and start saving serious money, it's time to take action. Reach out to a mortgage broker today to explore your options and take the first step toward financial freedom. With the right guidance and determination, you can turn your April Fool's Day into a celebration of financial success. Let's make it happen together.

All Rights Reserved | The Mortgage Centre - Elite | Privacy Policy

Website produced by Evolv Digital Marketing Inc.